Mistakes happen, especially when managing finances. You might enter a deposit twice, record an incorrect amount, or realize a deposit never actually occurred. While QuickBooks offers options to correct these errors, simply “deleting” a deposit isn’t always the best or safest approach. It can have significant ripple effects on your financial records, especially your bank reconciliation.

This guide will walk you through the process of correcting or, if necessary, deleting a deposit in both QuickBooks Desktop and QuickBooks Online, always emphasizing caution and best practices.

Important Considerations Before You Delete

Before you click any delete buttons, understand the potential consequences:

1. Bank Reconciliation: If the deposit was part of a previous bank reconciliation, deleting it will throw off that reconciliation and any subsequent ones. This is the biggest headache

2. Linked Transactions: Deposits often include customer payments received. Deleting the deposit will “un-deposit” those payments, making the invoices appear unpaid again and potentially confusing your Accounts Receivable.

3. Audit Trail: Deleting a transaction removes its historical record. Voiding, on the other hand, leaves a record (a zero-value transaction) which is generally preferred for audit consistency.

4. Reporting Accuracy: Your Profit & Loss, Balance Sheet, and other reports will change for the period the deposit was recorded, which could misrepresent your financial position if not corrected properly.

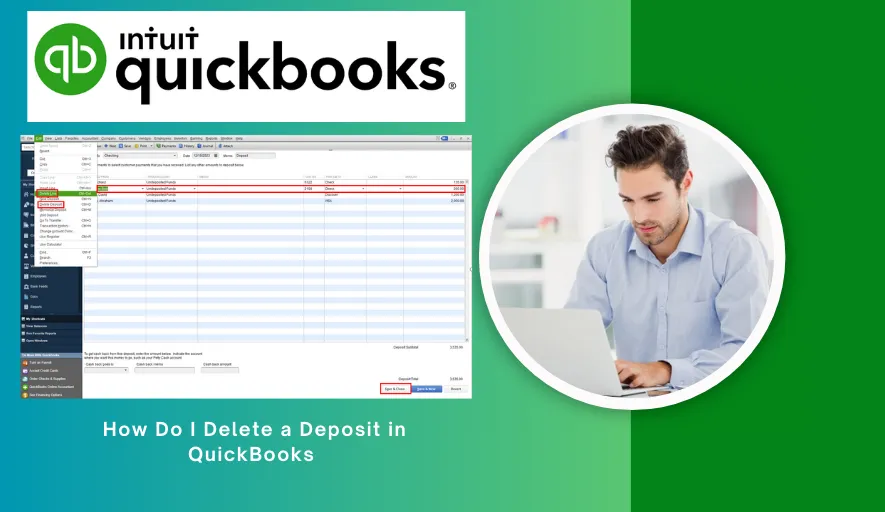

QuickBooks Desktop: Correcting or Deleting a Deposit

QuickBooks Desktop offers more direct control over individual transactions.

Scenario 1: The Deposit Has NOT Been Reconciled

This is the easiest scenario.

1. Locate the Deposit:

- Go to Banking > Make Deposits

- If it’s the most recent deposit, you might see it directly. Otherwise, click the “Previous” arrow multiple times until you find it, or click “Find” to search by date or amount.

- Alternatively, go to Lists > Chart of Accounts, double-click on the bank account the deposit was made to, and scroll through the register to find the transaction.

2. Correcting an Error (Preferred):

- If you just need to change the date, amount, or memo, make the necessary edits directly on the deposit screen.

- Ensure all included payments are correct. You can uncheck payments to remove them from this deposit and check others to add them.

- Click Save & Close.

3. Voiding the Deposit (Recommended over Deleting for Audit Trail):

- With the deposit open on your screen (either from the “Make Deposits” window or the bank register).

- Go to Edit > Void Deposit.

- QuickBooks will change the amount to zero and mark it as “Void.” It remains in your records, which is good for your audit trail.

- Click Save & Close.

4. Deleting the Deposit (Use with Extreme Caution):

- With the deposit open on your screen.

- Go to Edit > Delete Deposit.

- QuickBooks will prompt you with a warning. Confirm you want to delete it.

Important: If the deposit included customer payments, those payments will now be unapplied and will show as “undeposited funds” or “customer credits” or be available to be deposited again. You’ll need to go to Customers > Receive Payments to re-apply them to invoices or include them in a new, correct deposit.

- Click Save & Close.

Scenario 2: The Deposit HAS Been Reconciled

This is more complex. Do NOT simply delete or void a reconciled deposit. Doing so will throw off your previous reconciliations and create significant headaches.

Option A: Make an Adjusting Journal Entry (Recommended)

- This is the cleanest method. You’ll create a journal entry to reverse the effect of the incorrect deposit without touching the original, reconciled entry.

- Go to Company > Make General Journal Entries.

- Date: Use the date you are making the correction (not the original deposit date).

- Line 1: Debit (increase) the appropriate income account (or an “Error Correction” account) for the amount of the incorrect deposit. Add a detailed memo.

- Line 2: Credit (decrease) the bank account where the deposit was incorrectly made for the same amount. Add a detailed memo.

- You are essentially pulling the money out of the bank account and putting it somewhere else on paper, to counteract the incorrect deposit that was put in. This will appear on your next bank reconciliation.

Option B: Undo the Reconciliation (Absolute Last Resort!)

- Only do this if you are absolutely sure and understand the implications. Undoing a reconciliation can be very disruptive.

- Go to Banking > Reconcile.

- Click Undo Last Reconciliation. Repeat if necessary until you go back to the reconciliation that includes the problematic deposit.

- Once undone, follow the steps in Scenario 1 to Void or Delete the deposit.

- Crucially, you will then need to re-reconcile all the affected months from that point forward to ensure accuracy. This is time-consuming and prone to errors.

QuickBooks Online: Correcting or Deleting a Deposit

QuickBooks Online (QBO) handles deposit a bit differently, especially if they are linked to received payments.

Scenario 1: The Deposit Has NOT Been Reconciled

1. Locate the Deposit:

- Go to Transactions > Chart of Accounts.

- Find the bank account the deposit was made to and click “View register” or “Run report.”

- Locate the deposit transaction.

- Alternatively, go to Sales > All Sales (or Customers & Leads > Customers then select a customer and view their transactions) and filter by “Deposits.”

2. Open the Deposit:

- Click on the deposit transaction to open its details.

3. Correcting an Error (Preferred):

- If it’s a simple deposit (not linked to customer payments) you can just edit the amount, date, or memo directly. Click Save and Close.

- If the deposit includes payments:

- You’ll see a list of payments included in the deposit.

- To remove a payment from this deposit, simply uncheck the box next to that payment.

- To add other payments, click “Add other funds” or “Add funds to this deposit” (the exact wording may vary).

- Adjust the total deposit amount if necessary.

- Click Save and Close. The payments you removed will go back to being “Undeposited Funds” or “Receive Payments” and can be included in a new, correct deposit.

4. Deleting the Deposit (Use with Caution):

- Open the deposit.

- If the deposit includes payments, you must first uncheck all included payments. Once all payments are unchecked, the deposit amount will become zero.

- Once the deposit is empty (amount is $0.00), you will see the More button at the bottom of the screen (or top right, depending on layout). Click More > Delete.

- Confirm the deletion.

Important: As with Desktop, the payments will return to “Undeposited Funds” or be available to be deposited again. You’ll need to create a new, correct deposit.

- If the deposit was a direct entry (not linked to payments), you may see the “Delete” button directly without needing to zero it out first.

Scenario 2: The Deposit HAS Been Reconciled

Similar to Desktop, do not directly delete or void a reconciled deposit in QBO.

Option A: Make an Adjusting Journal Entry (Recommended)

- Go to + New > Journal Entry (under “Other”).

- Date: Use the date you are making the correction.

- Line 1: Debit (increase) the appropriate income account (or an “Error Correction” account) for the amount of the incorrect deposit. Add a detailed memo.

- Line 2: Credit (decrease) the bank account where the deposit was incorrectly made for the same amount. Add a detailed memo.

- Click Save and Close. This entry will appear on your next reconciliation.

Option B: Undo the Reconciliation (Absolute Last Resort!)

This is generally strongly discouraged in QBO as it can be very complex.

- Go to Transactions > Chart of Accounts.

- Find the bank account and click “View register.”

- Locate the reconciled deposit. In the “Reconcile” column (often indicated by a small “R”), click on the “R.” It will change to a blank space or “C” (cleared). This un-reconciles that specific transaction.

- Once un-reconciled, you can then proceed to delete the deposit as described in Scenario 1.

Warning: This method only un-reconciles that one transaction, not the entire reconciliation. While it might seem easier, it can lead to confusion in future reconciliations if not handled carefully. A journal entry is almost always safer.

When to Void vs. When to Delete

Void: Use when the transaction did occur but was incorrect or needs to be nullified. It leaves a historical record (showing a $0 value), which is excellent for audit trails and understanding past actions. This is generally the preferred method for most corrections.

Delete: Use only when the transaction never happened at all and you want no trace of it. This should be a rare occurrence, especially for reconciled items, as it leaves a gap in your numbering or record keeping.

Final Advice: Consult a Professional

If you’re unsure about how to correct a deposit, especially one that has already been reconciled, it’s always best to consult with a QuickBooks ProAdvisor or your accountant. They can help you navigate the process without inadvertently creating more significant problems for your financial records. Getting it right the first time will save you headaches down the line.